Rapid City, South Dakota (KOTA) Recently, a number of tax increment financing districts have emerged in Rapid City, including the Block 5 Project and Sagebrush Flats Affordable Housing.

This may have some people asking what tax increment financing is.

Mike Dugan, the City of Rapid City’s tax increment finance planner, stated that a TIF is primarily used to finance public infrastructure, but it may also be utilised as a grant to assist with private development that adds amenities to a town.

He also stated that it contributes to the creation of new jobs, as well as new property and sales tax opportunities.

In addition, he stated that tax increment financing is frequently used for underdeveloped properties.

“Typically, the developer would go out to cover the TIF funding, would go out and seek outside funding from a finance institution or investors to provide those costs up front for the future development,” Dugan told me.

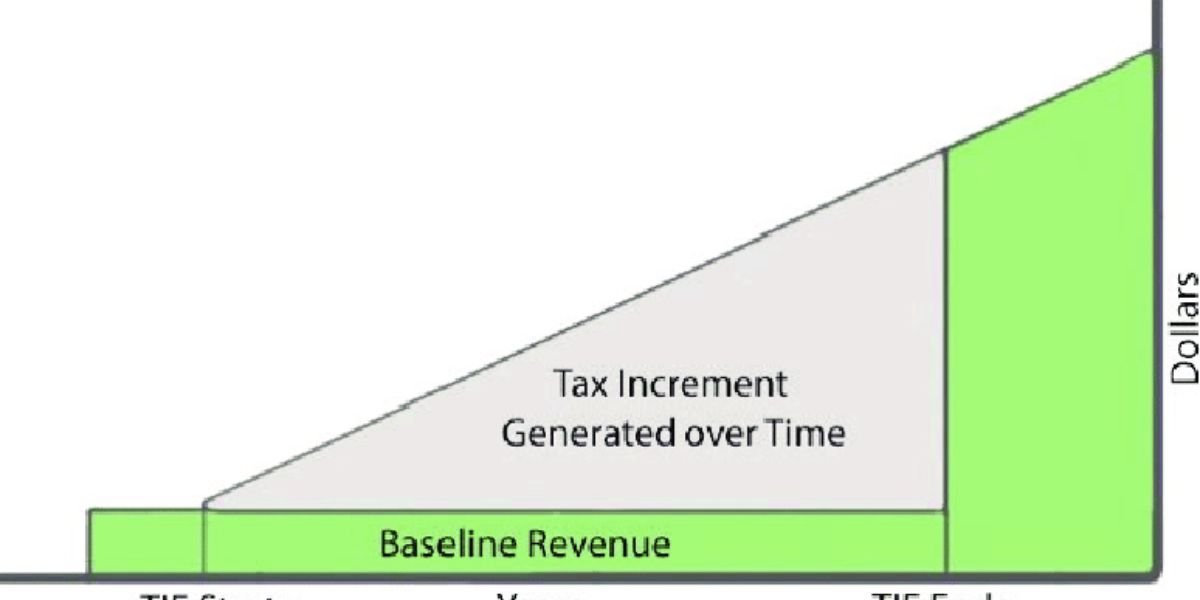

He stated that as improvements are made to a property, the TIF will earn additional property taxes from the development.

As a result, the property taxes generated by the developer’s new development over time can be utilised to repay a loan obtained from a financial institution or investor interested in the project.